why is pfizer stock so cheap

People are looking for growth. Pfizer Stock Is Cheap Relative to Its Peers PFE is now cheaper than its drug stock peers.

S P 500 Rises For A Third Day Nears Another Record

Those concerns have been around for.

. PFE Stock Has Deep Value. However stock prices prices reflect the markets valuation of a company. By headhe fundamentalists selling out and lowering it during massive market booms it makes private investors think it sucks and they sell their positions.

Because it will be the one that creates the REAL vaccine. Revenue and profits soared. Think of the absurd opportunity cost of holding them through the last 5 years.

Why Is Pfizer Stock So Low. There are innumerable inputs and metrics that go into these figu. I think there are maybe three.

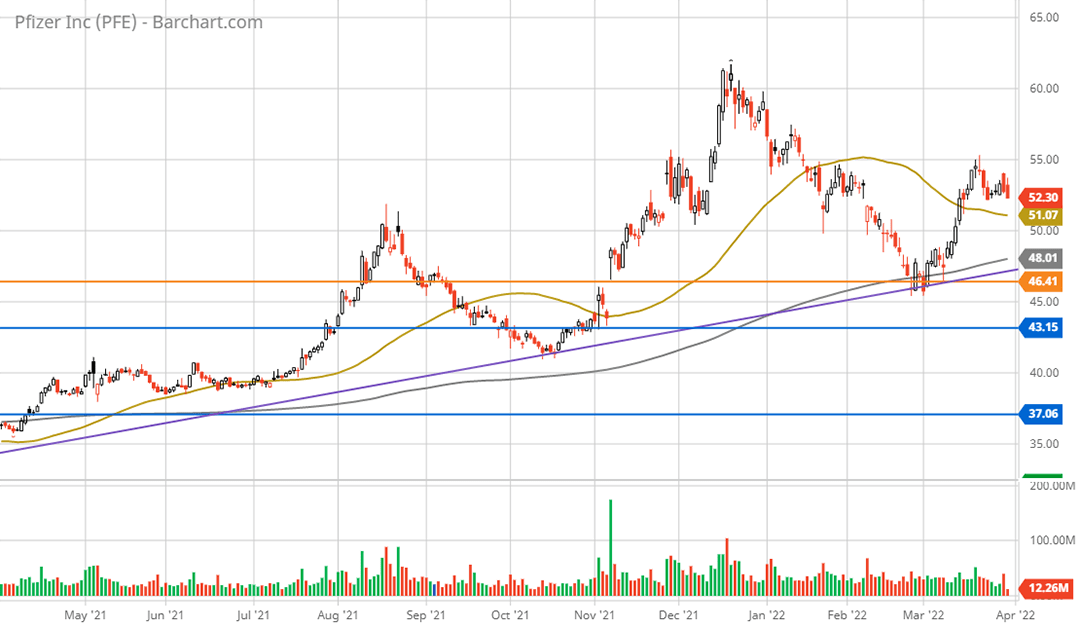

Ad Our Strong Buys Double the SP. It is cheap changing hands at a priceearnings ratio of just 144 at a time. And on the other hand from 2009 to 2019 the stock went from 106 to 4575.

Dont dismiss just how big of a difference a solid dividend can make on total returns. In the first quarter adjusted Pfizer earnings were 162 per share on 2566 billion in sales. Ad Biotech is becoming one of the best new sectors for investing if you know where to look.

One reason to buy Pfizer stock is its lush dividend yield of 425 more than double that of the SP 500. On average they predict Pfizers share price to reach 5726 in the next year. Earnings surged 72.

The Pfizer stock has improved by nearly 44 in the last 12 months and the analysts estimate the stock has a potential to return 120. The company reported revenue of. Modernas stock rose 28X in the past 2 years are these biotech picks next.

Pfizer is a much bigger company with numerous meds on the market and others in the pipeline. Their PFE stock forecasts range from 4400 to 7600. The regularly 115 premium would be worth 145.

Thats some solid growth. Pfizers total return was nearly twice as great with dividends included than without. Pfizers dividend yield has slipped below 32 only once over the past five years.

Today it is 33. The company reported revenue of. Shares of Pfizer gained downside momentum after the company released its fourth-quarter earnings report.

The stock spent much of. The big drugmaker even raised its full-year guidance. To preface my explanation I will assume that you expected Pfizers stock to increase substantially after developing a vaccine for COVID-19.

Answer 1 of 4. A perfect storm has battered the New York-based drug makers fortunes of late with rising concerns surrounding President Joe Bidens Medicare cost cutting plans. So all in all is PFE stock a buy.

So when it finally does pop there is more money to be made by big firms. Pfizer last reported earnings in late October where third quarter revenue dropped by 43 per cent to 1213 billion which was lower than the consensus estimate at 1232 billion. Earnings were a.

Even if PFE were to drop 04 over that. Pfizers stock has outperformed the broader markets as well as some of its peers over the last few weeks. And the answer seems to be based on very real concerns about the Pfizer business.

Shares of Pfizer gained downside momentum after the company released its fourth-quarter earnings report. PFE Stock Has Deep Value Trading at a forward price-to-earnings of around 125 times Pfizer trades in deep value territory. PFE DATA BY YCHARTS.

InvestorPlace Stock Market News Stock Advice Trading Tips Grading 10 of 2020s Hottest SPACs in Preparation for the New Year I recently looked at some cheap picks that have become not-so-cheap over the past month or so. Moderna has no med that has been approved for distribution yet. View analysts price targets for Pfizer or view.

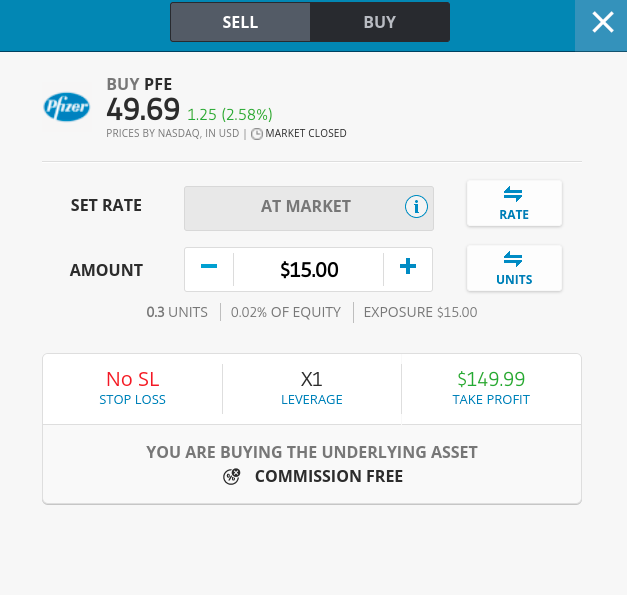

Pfizer PFE 056 recently announced very good first-quarter results. Take a look at the impact of Pfizers dividend over the last 10 years. This suggests a possible upside of 104 from the stocks current price.

The stock spent much of the last half-decade since 2016 in the 30 to. 18 Wall Street research analysts have issued 1-year price objectives for Pfizers shares. For example PFE trades at a forward price-earnings ratio of 14 and has a 39 dividend yield.

Based On Fundamental Analysis. While Pfizer stock grew 325 since the. The question however is why Pfizer stock seems so cheap.

Ad Five Under-The-Radar Investments You Cant Afford to Miss. And there are still a number of cheap stocks out there waiting to fetch a bid from buyers. A whopping 26 gain without any underlying movement.

Even if youre 100 convinced that you want to buy the stock you should understand why somebody is selling it to you at this price that youre willing to buy it at. Answer 1 of 5. Shares in the American pharmaceutical corporation Pfizer PFE are currently trading 17 down from their all-time August closing highs of 5042.

Trading at a forward price-to-earnings of around 125 times Pfizer trades in deep value territory. Five Stocks That Will Define The Next Decade of Retirement. They do have quite a few programs in clinical trials and a total of 20 developmental candidates.

:max_bytes(150000):strip_icc()/4-6d6ad667049442be82eba9859b909770.jpg)

Pfizer Positioned For Future Upside

Pfizer Stock Is Pfe Stock A Buy As Fda Considers Its Omicron Specific Shot Investor S Business Daily

:max_bytes(150000):strip_icc()/3-3a4c5d6eab9c47f9a0cca1daa0f78c42.jpg)

Pfizer Positioned For Future Upside

Pfizer Pfe How It Could Double Seeking Alpha

Does The Current Dip In Pfizer Stock Offer A Buying Opportunity

Pfizer Inc S Nyse Pfe Stock Is Going Strong Have Financials A Role To Play

:max_bytes(150000):strip_icc()/1-d656e003d5bb4c5f849f55b3e2b4deb6.jpg)

Pfizer Positioned For Future Upside

How To Buy Pfizer Stock Is Pfizer A Buy In June 2022

Pfe Stock Today Why This Income Generating Option Strategy Makes Sense Now Investor S Business Daily

:max_bytes(150000):strip_icc()/2-c76254839cdd45a596956aa6e11b5405.jpg)

Pfizer Positioned For Future Upside

How To Buy Pfizer Stock Is Pfizer A Buy In June 2022

Nasdaq Jumps 1 Dow Climbs 370 Points As Wall Street Shakes Off A Slow Start To The Week

Moderna Pfizer Stocks Fall As Covid Omicron Wave Subsides In U S

How To Buy Pfizer Stock Is Pfizer A Buy In June 2022

How To Buy Pfizer Stock Is Pfizer A Buy In June 2022

S P 500 Falls As Market Struggles To Recover From Multiple Weeks Of Losses Nasdaq Down More Than 1