aurora co sales tax 2021

There is no applicable special tax. What is the sales tax rate in Aurora Colorado.

19410 E Pacific Dr Aurora Co 80013 Mls 4002615 Redfin

The December 2020 total local sales tax rate was also 8000.

. Download and file the Retail Delivery Fee Return DR 1786 to register a Retail Delivery Fee account. The County sales tax rate is. This is the total of state county and city sales tax rates.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. For tax rates in other cities see Missouri sales taxes by city and county. This is the total of state county and city sales tax rates.

Note that the State of Colorado has enacted the same clarification. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. Top Property Taxes Aurora East.

Aurora took a major step Monday toward eliminating the citys sales tax on menstrual products putting it in line to. General Median Sale Price Median Property Tax Sales Foreclosures. With CD 290 000 010 025 375.

Fast Easy Tax Solutions. The Colorado sales tax rate is currently. The minimum combined 2022 sales tax rate for East Aurora New York is.

The County sales tax rate is. The East Aurora sales tax rate is. 2 beds 1 bath 560 sq.

19900 East Montview Drive. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The council voted to lift the 375 city sales tax on tampons and similar items in 2021.

Method to calculate Aurora sales tax in 2021. Did South Dakota v. 2021 cost of living calculator for taxesaurora colorado and denver colorado.

Aurora-RTD 290 100 010 025 375. Wholesale sales are not subject to sales tax. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

The Sales tax rates may differ depending on the type of purchase. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. Colorado has recent rate changes Fri Jan 01 2021.

Gardner also framed the measure in the context of a Colorado House of Representatives bill that would waive the state sales tax on diapers and menstrual products a goal that has earned bipartisan support. House located at 1757 Galena St Aurora CO 80010 sold for 230700 on Mar 30 2021. General Median Sale Price.

With local taxes the total sales tax rate is between 2900 and 11200. This sales tax will be remitted as part of your regular city. Wayfair Inc affect Colorado.

One removes the sales. The Aurora Sales Tax is collected by the merchant on all qualifying sales. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc.

In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5. For tax rates in other cities see Colorado sales taxes by city and county. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax.

Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. The state sales tax rate in Colorado is 2900. Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations.

March 8 2021 at 748 pm. The clarifying city ordinance can be found at this link. The Aurora Sales Tax is collected by the merchant on all qualifying sales.

Aurora Sales Tax Rates for 2022. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Effective July 1 2022.

The New York sales tax rate is currently. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. 24 lower than the maximum sales tax in CO.

Ad Find Out Sales Tax Rates For Free. Subdivision in Aurora CO. Council members voted 6-3 on Monday to waive the.

The minimum combined 2022 sales tax rate for Aurora Colorado is. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Select the Colorado city from the list of popular cities below to see its current sales tax rate.

Method to calculate Aurora sales tax in 2021. The Sales tax rates may differ depending on the type of purchase. Method to calculate Aurora sales tax in 2021.

The current total local sales tax rate in Aurora CO is 8000. Download all Colorado sales tax rates by zip code. Integrate Vertex seamlessly to the systems you already use.

The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. You can print a 9225 sales tax table here. The Aurora sales tax rate is.

Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle to a location in Colorado. View sales history tax history home value estimates and overhead views. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

Did South Dakota v. Aurora to become first Colorado city to exempt diapers from city sales tax The City Council approved the measure on a 6-3 vote Monday night. This clarification is effective on June 1 2021.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. You can print a 85 sales tax table here. 1 Reduced collection of sales tax from certain businesses in.

What is the sales tax rate in East Aurora New York. March 8 2021 at 745 pm. Information reflective of 2021 Recorder Assessor Data.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. The County sales tax rate is. The average Sales Tax Accountant salary in Aurora CO is 54834 as of October 29 2021 but the salary range typically falls between 47767 and 61856.

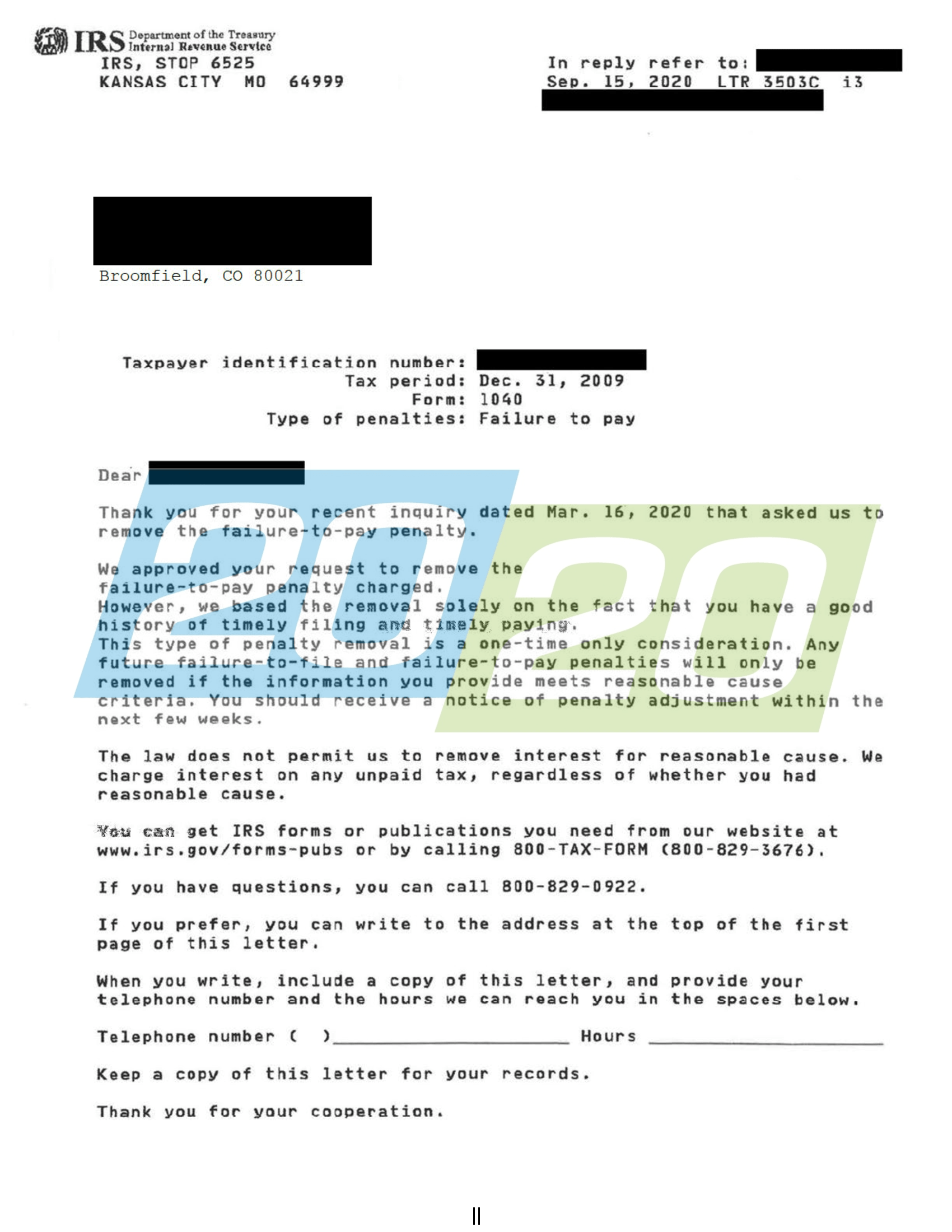

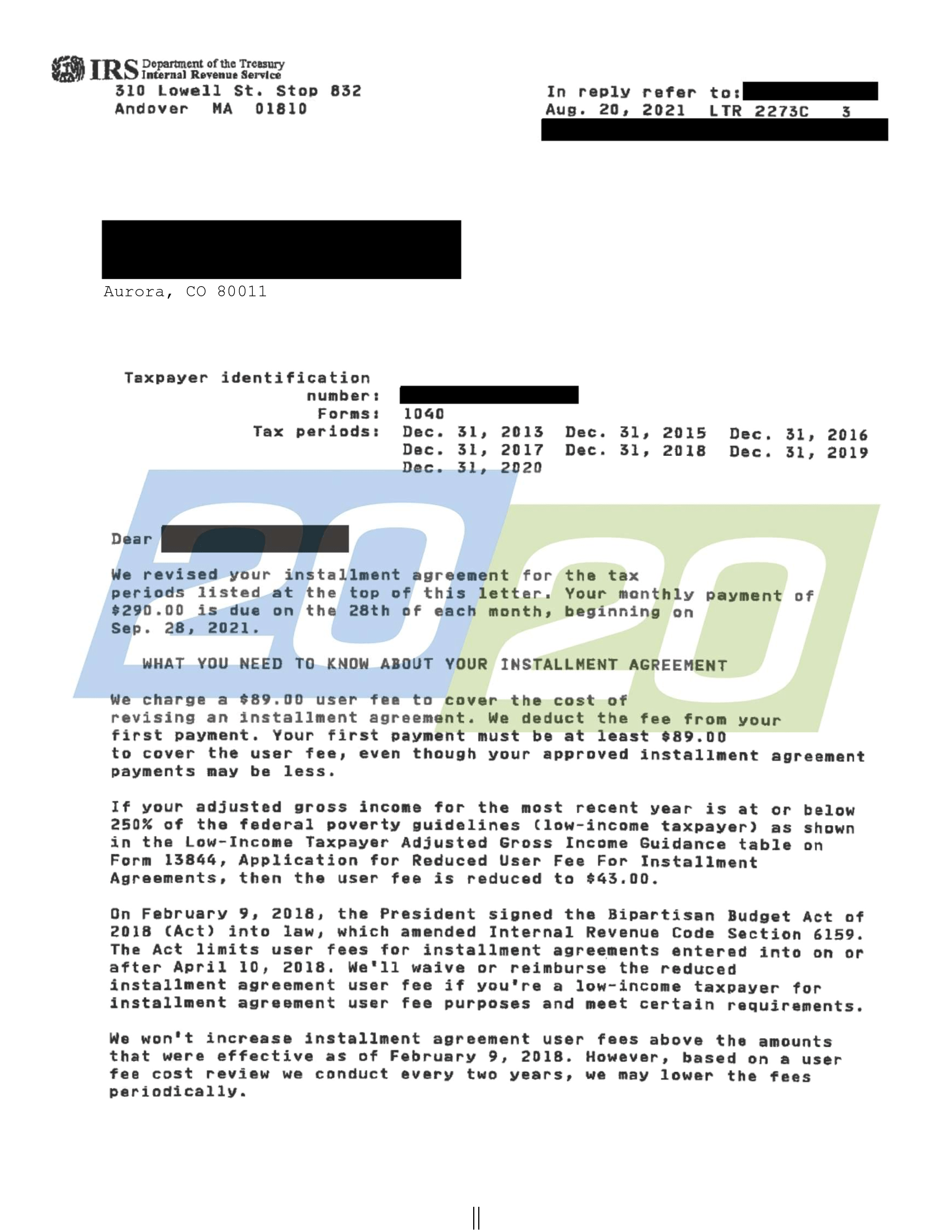

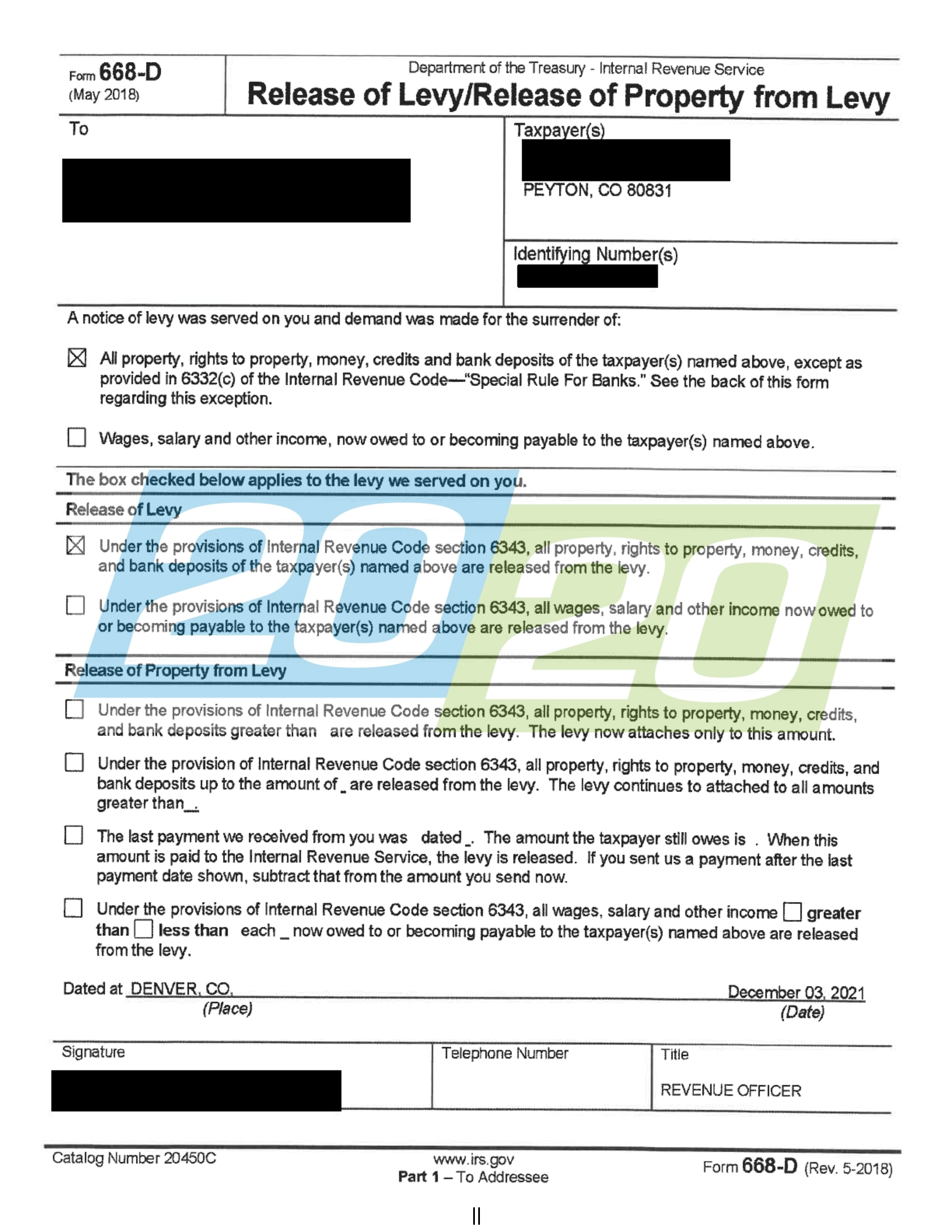

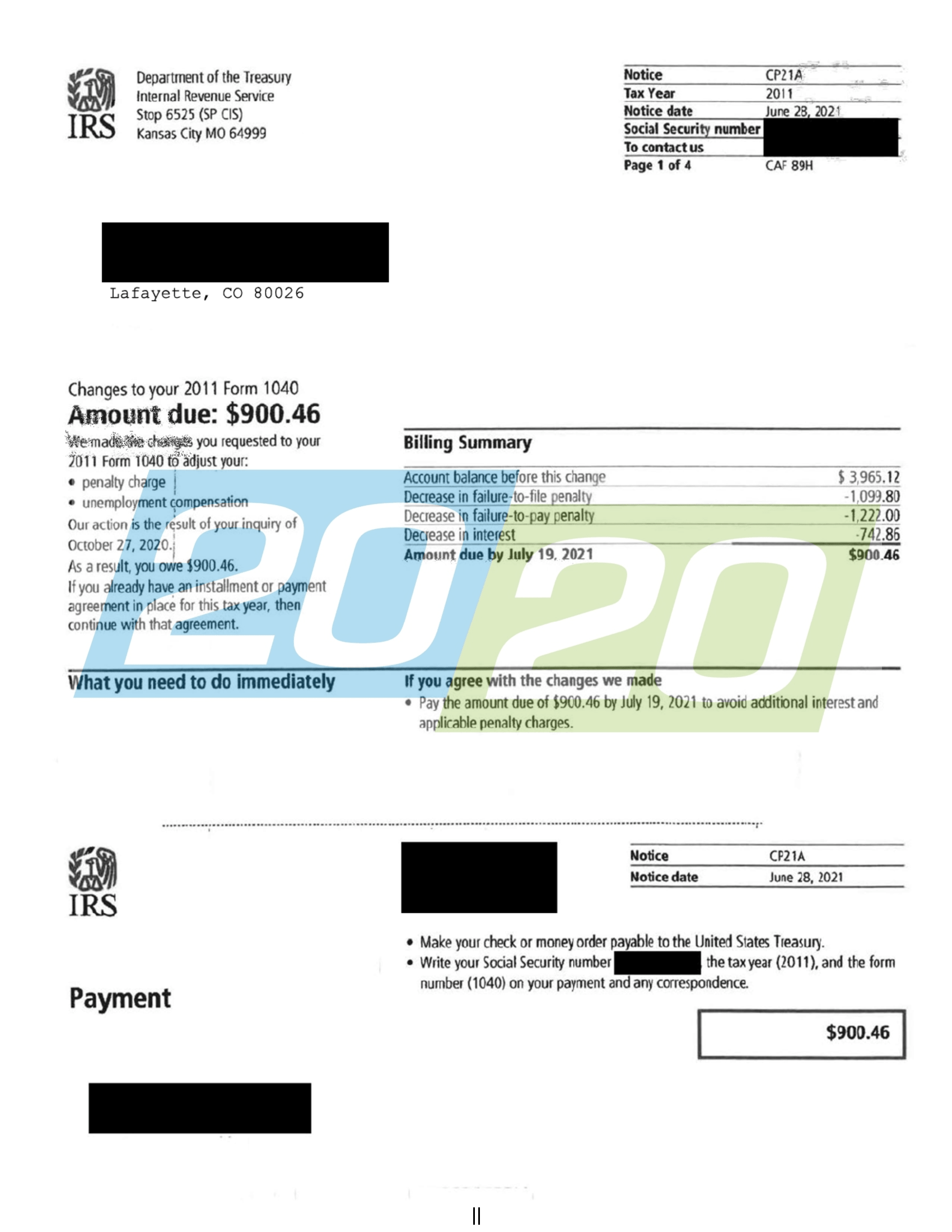

Tax Resolutions In Colorado 20 20 Tax Resolution

Tax Resolutions In Colorado 20 20 Tax Resolution

24476 E Fremont Dr Aurora Co 80016 Mls 3718952 Redfin

Tax Resolutions In Colorado 20 20 Tax Resolution

7148 S Elk Ct Aurora Co 80016 Mls 8767412 Redfin

Tax Resolutions In Colorado 20 20 Tax Resolution

24476 E Fremont Dr Aurora Co 80016 Mls 3718952 Redfin

Sales Tax Filing Information Department Of Revenue Taxation

Tax Resolutions In Colorado 20 20 Tax Resolution

Tax Resolutions In Colorado 20 20 Tax Resolution

4043 S Jebel Way Aurora Co 80013 Mls 8851610 Redfin

19410 E Pacific Dr Aurora Co 80013 Mls 4002615 Redfin

19809 E Girard Ave Aurora Co 80013 Mls 2223670 Redfin

Aurora Co Mobile Manufactured Homes For Sale Realtor Com

Aurora Co Mobile Manufactured Homes For Sale Realtor Com

Aurora Co Mobile Manufactured Homes For Sale Realtor Com